Enter your username and password in the Parent Sign In section in PowerSchool.

Expand the left Navigation menu and click Forms.

Click Application for Free and Reduced Price School Meals from the optional registration forms.

Apply for Free and Reduced Price Meals!

Instructions from Chrome or Safari on your phone or computer:

Instructions from the PowerSchool app:

Click More at the bottom right of your screen.

Click Forms.

Click Application for Free and Reduced Price School Meals from the optional registration forms.

Eligibility Criteria for Free and Reduced Price Meals

Family/Household means a group of people who may or may not be related and who do not live in an institution or a boarding house, but who are living as one economic group. Students who are temporarily away at school should be counted as members of the family; however, students who are full-time residents of an institution are considered a family of one.

Gross Income means income before deductions for income taxes, employee's social security taxes, insurance premiums, charitable contributions, bonds, etc. It includes the following:

Monetary compensation for services, including wages, salary, commissions, or fees;

Net income from non-farm self-employment;

Net income from farm self-employment;

Social security;

Dividends or interest on savings or bonds or income from estates or trusts;

Net rental income;

Public assistance or welfare payments;

Unemployment compensation;

Government civilian employee or military retirement, or pensions, or veterans payments;

Private pensions or annuities;

Alimony or child support payments;

Regular contributions from persons not living in the household;

Net royalties; and

Other cash income. Other cash income would include cash amounts received or withdrawn from any source including savings, investments, trust accounts, and other resources which would be available to pay the price of a child's meal.

Income does not include any income or benefits received under any Federal program, which are excluded from consideration as income by any legislative prohibition.

In a household where there is income from wages and self-employment and the self-employment reflects a negative net income, consider that income as zero so as not to offset the wages earned.

In applying guidelines, the family's current rate of income should be used in determining eligibility.

Current Income is defined as income received during the month prior to application if such income is representative. Where the prior month's income was much higher or lower than usual, expected income for this year (12 months starting from the prior month) may be used; for example, self-employed people, farmers, and migrant workers.

Foster Children whose care and placement is the responsibility of the State, or who is placed by a court with a caretaker household, is categorically eligible for free meals and may be certified without an application. Whether placed by the State child welfare agency or a court, in order for a child to be considered categorically eligible for free meals, the State must retain legal custody of the child. Households with foster and non-foster children may choose to include the foster child as a household member, as well as any personal income earned by the foster child on the same household application that includes the non- foster children. Foster children on the DC list are free eligible. Foster children cannot extend eligibility to household members.

Institutionalized Children are considered a one-member family and only monies the child actually receives and controls shall be considered as income for determining eligibility.

Adopted Children for whom a household has accepted legal responsibility is considered to be a member of that household. If the adoption is a “subsidized” adoption, which may include children with special needs, the subsidy is included in the total household income.

Because some adopted children were first placed in families as foster children, parents may not be aware that, once the child is adopted, he/she must be determined eligible based on the economic unit and all income available to that household, including any adoption assistance, is counted when making eligibility determination.

Lathrop School District Meal Charge Policy

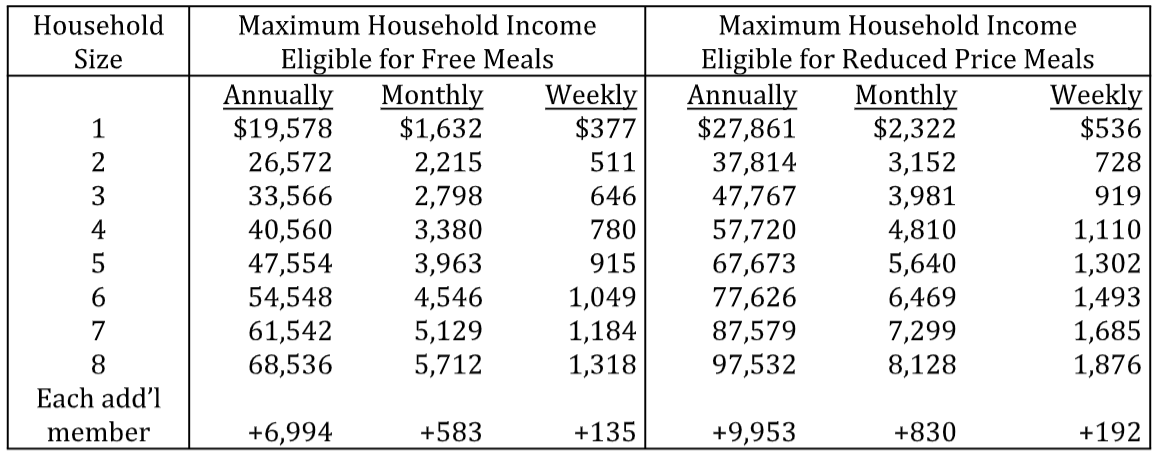

Lathrop R-II School District participates in the National School Lunch Program and offers healthy lunch and breakfast meals every school day. Applications to receive free or reduced price meals are available on PowerSchool or any building office. These applications can be made and revised any time during the year. A new form must be completed each school year. Please contact the office at your child’s school if you need assistance filling out the application.

Free and reduced lunch includes (1) hot lunch/salad bar and (1) milk. Free and reduced breakfast includes breakfast entrée, fruit or juice and (1) milk. Any other items will be charged at our retail price. If students wish to purchase ala-carte items, they should make sure they have money in their lunch account prior to the purchase as they cannot be charged. If they do not have money in their account, they will be asked to return pre-packaged ala-carte items at the point of sale.

Parents can monitor their student’s lunch account balance and make payments online through PowerSchool. Payments may also be made at one of the school offices. Students not qualifying for free meals must have money in their account in order to purchase a regular meal and/or ala carte items. Students will not be able to charge a lunch on another student’s lunch account.

Students will be notified of low or negative lunch account balances at the point of sale and notices will be sent home via email and/or letter. Lunch charges may not exceed three days. Once a child has exceeded the three-day limit for charges, they will not be served a regular menu item. Instead, they will be served an alternate meal, such as a SunButter sandwich along with a carton of milk, at a cost of $1.00.